The OECD report provides information on the annual amounts of climate finance for 2013-2018 provided and attracted by developed countries for developing countries in the context of the processes of the United Nations Framework Convention on Climate Change (hereinafter - UNFCCC).

This report is the third OECD assessment of progress towards the UNFCCC's goal of raising $ 100 billion. The project aims to help developing countries overcome and adapt to the effects of climate change by 2020.

The analysis is based on four separate components:

- bilateral public financing of the fight against climate change by developed countries; multilateral public financing of the fight against climate change related to developed countries;

- climate-related export credits officially granted by developed countries;

- private financing attracted by bilateral and multilateral public climate finance.

Thus, the data presented in the report does not cover the full cost of financing climate change actions in developing countries. In particular, they exclude domestic and public South-South climate finance, multilateral climate finance for developing countries, and private financing.

Cumulative tendencies

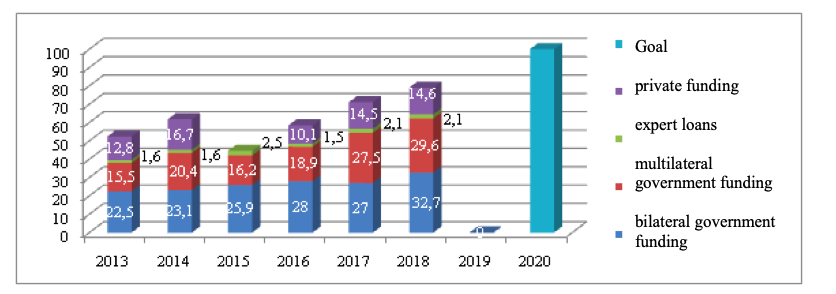

Climatic financing provided and attracted by developed countries for developing countries amounted to $ 78.9 bln. In 2018, which is 11% more than $ 71.2 billion. .

For the period 2016-2018, climate finance increased by 22%, in the period from 2016 to 2017 (from $ 58.6 billion to $ 71.2 billion) and by 11% between 2017 and 2018.

Figure 1. Climate finance for 2013-2018.

The report shows that government climate finance from developed countries has reached $ 62.2 billion. in 2018. Bilateral public climate finance accounted for $ 32.7 billion, up 21% over 2017, while multilateral public climate finance attributed to developed countries was $ 29.6 billion, up 8 % compared to 2017. . . The level of private climate finance leverage remained virtually unchanged, reaching $ 14.6 billion in 2018 after $ 14.5 billion in 2017. . .

. Climate-related export credits remained small at $ 2.1 billion, less than 3% of total climate finance.

The report shows that of the total climate change funding in 2018, 70% was allocated to climate change mitigation activities, 21% to adaptation, and the remainder to integrated interventions. More than half of all climate finance goes to economic infrastructure - mainly energy and transport - with most of the remainder going to agriculture and social infrastructure, especially water and sanitation.

Sectoral distribution

The energy sector, as well as the transport and storage sector, were the target sectors in the context of overall climate change financing provided and attracted by developed countries in 2016-2018.

At an annual average of $ 23.8 billion, climate finance for energy accounted for 34% of the three-year average. .

- energy - $ 23.8 billion, 34%

- transport and storage - $ 9.7 billion, 14%

- agriculture, forestry and fisheries - $ 6 billion 9%, water supply and sewerage - $ 2 billion. , 7%

- banking and business services - $ 3.4 billion , 5%

Climate finance for other sectors averaged $ 13.4 billion (19%) per year over a three-year period, mainly including general environmental protection, health care, education, other social infrastructure, and the diversified sector. . For the remaining 11% ($ 7.9 billion) of the three-year average, the sector of beneficiaries was not indicated. .

Broken down by climate finance in different sectors by climate focus, mitigation finance clearly dominates the energy sectors (96%).

- energy (96%)

- transport and storage (88%)

- mining and construction (82%)

- banking and business services (79%).

In contrast, adaptation financing accounts for the largest share in water supply and sanitation (63%).

- water supply and sanitation (63%)

- agriculture, forestry and fisheries (52%)

- social infrastructure (44%)

- general environmental protection (39%)

- agricultural industry

- forestry and fisheries (20%)

- other (17%).

The energy sector accounted for 34% of the total climate finance provided by developed countries in 2016-2018, the highest share among all sectors. On average, this amounts to $ 23.8 billion. $ per year, of which:

- . $ 12.5 billion (53%) are targeted projects for the production of energy from renewable sources, in particular, solar, wind and hydropower;

- . $ 1.2 billion (5%) for targeted energy production from selected non-renewable sources, mainly including natural gas, hybrid and waste fired power plants. Coal-related financing is completely excluded from this data;

- $ 2.2 billion (9%) was spent on energy distribution (electricity and gas);

- $ 7.8 billion (33%) Is related to energy policy, efficiency or unspecified activities in the energy sector (referred to as “energy in general”).

Of the $ 23.8 billion per year, An average of 61% came from public climate finance, mainly in the form of loans (84% of public finance provided) and to a lesser extent grants (13%) and equity.

2% - investments

33 % - attracted from the private sector

6% - associated with officially supported export credits.

Overall, 96% of energy-related climate finance was devoted to climate change mitigation.

Asia received the largest share (46%) of energy-related climate finance. This is mainly due to the large amounts allocated to South and East Asia. Africa and the Americas accounted for about a quarter of the allocated funds (26% and 22%, respectively).

Geographical distribution of the beneficiary regions of climate finance provided and mobilized by developed countries in 2016-2018.

- Asia - $ 30 billion (43%) per year

- Africa - $ 17.3 billion (25%) per year

- USA-$ 12 billion. (17%) per year

- Non-EU / EEA Europe - $ 2.4 billion (4%) per year

- Oceania - $ 0.5 billion (1%) per year

Middle-income countries were the main recipients of climate finance in 2016-2018.

While bilateral public climate finance is primarily targeted at lower-middle-income countries, multilateral public climate finance and attracted private finance are more evenly distributed between lower-middle-income and upper-middle-income countries.

Attracting private funding to fight climate change

The OECD has developed an international standard for measuring the amounts raised from the private sector, including for combating climate change. The work was carried out over several years and through successive rounds of research, stakeholder consultations, surveys, methodological developments, and implementation.

The total volume of attracted private financing attributed to developed countries (including climate and non-climate finance) remained stable in 2016 ($32.4 billion) and in 2017 ($33.1 billion). and increased significantly, reaching $ 42.6 billion. in 2018 (compared to the same period last year; an increase of 29%).

The data collected by the OECD makes it possible to distinguish between mechanisms for attracting private financing. Thus, the report distinguishes between guarantees, syndicated loans, shares in collective investment mechanisms (CIV), direct investments in companies or special purpose mechanisms (SPV), credit lines and simple co-financing mechanisms.

During 2016-2018, most of the private climate finance was raised through direct investment in companies or SPVs.

- SPV 43%

- guarantees 23%

- syndicated loans 14%

- guarantees from 2016 to 2018 15% - 31%

- syndicated loans 7%-19%

In contrast, the share of private climate finance raised through direct investment in companies or special purpose SPV mechanisms fell from 54% in 2016 to 33% in 2018. In addition, the share of private climate finance raised through shares in CIV and co-financing remained relatively modest over the three-year period (4% and 6%, respectively). Credit lines, which accounted for 13% in both 2016 and 2017, declined significantly in 2018, to just 6%.

More than 93% of the private climate change financing raised by developed countries in 2016-2018 is aimed at mitigation. Adaptation and intersectoral funding accounted for between 3% and 4%. The respective relative shares of mitigation, adaptation, and cross-sector financing were almost identical every three years.

Private charitable foundations represent a new source of funding for climate change efforts in developing countries. Since thes.organizations are funded from private sources (for example, donations from wealthy individuals and companies, investment income, royalties, or lotteries), the climate funding they provide is not included in the amount of government climate funding in this report. Since the financial activities of such funds are usually not related to public climate finance measures, they are also unlikely to be included in the component of attracted private financing.

The information presented here provides an overview of the distribution of climate-related funding from charities headquartered in developed countries, based on new statistics from the OECD Development Assistance Committee on private philanthropy for development. In 2018, the thirty-three largest funds operating in developing countries contributed $ 0.6 billion to the fund. Climate change-related financing (8% of the development-related fund commitments, which amounted to $ 6.9 billion). . Data available since 2017 and compiled using the Rio Markers methodology show that in 2017-2018, funds focused more on mitigation (53%) than adaptation (13%), and the proportion of cross-sectoral interventions aimed at achieving both goals was 34%.

These funds are mainly related to grants supporting projects and programs implemented by NGOs, research institutes and through other channels (46%), as well as general support for civil societ.organizations working in the field of climate (46%). Technical assistance and capacity - building accounted for approximately 2 per cent of the average annual investment, while programme investment accounted for less than 1 per cent. In terms of sectors, the funds ' support for climate change activities focused primarily on clean energy and sustainable agriculture, as well as on broader environmental policies, including climate management.